Irs Estimated Taxes 2025

Irs Estimated Taxes 2025. Plan your next tax return due in 2025. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Sign up now to obtain new tax calculator updates. Estimated taxes consist of multiple parts:

Estimated Taxes Consist Of Multiple Parts:

Extending all provisions from the tcja that are set to expire at the end of 2025 would increase deficits by $2.7 trillion from 2024 to 2033, according to cbo and.

Married Medicare Beneficiaries That File Separately Pay A Steeper Surcharge Because.

Feel confident with our free tax calculator.

Irs Estimated Taxes 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, 2025 is also the last year for two tax breaks not in the 2017 law: Tax calculator for this calendar year or 2024.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, Estimate taxes for independent contractor income, unemployment benefits and irs payments. Feel confident with our free tax calculator.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, As your income goes up, the tax rate on the next. You will need to create an irs online account before using this option.

Source: bookkeeperla.com

Source: bookkeeperla.com

How to Pay Your IRS 1040ES Estimated Taxes THE Ultimate Bookkeeper, Federal income tax rates and brackets. Extending all provisions from the tcja that are set to expire at the end of 2025 would increase deficits by $2.7 trillion from 2024 to 2033, according to cbo and.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200040 Average Effective Federal Tax Rates All Tax Units, By, Use this effective tax bracket calculator to estimate your taxes and. Plan your tax withholding, tax refund, or taxes due.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. The expansion of the obamacare health premium credit to more individuals who buy.

Source: valerywanthe.pages.dev

Source: valerywanthe.pages.dev

Estimated Tax Payments 2024 Dates Uta Zorana, Based on your projected tax withholding for the year, we can. On this page, we will post the latest tax information relating 2025 as it is provided by the irs.

Source: www.youtube.com

Source: www.youtube.com

How to pay IRS estimated tax payments YouTube, Filing deadline for 2023 taxes. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024,.

Source: www.youtube.com

Source: www.youtube.com

How to pay estimated quarterly taxes to the IRS YouTube, You will need to create an irs online account before using this option. View the amount you owe, your payment plan details, payment history, and any scheduled or.

Source: napkinfinance.com

Source: napkinfinance.com

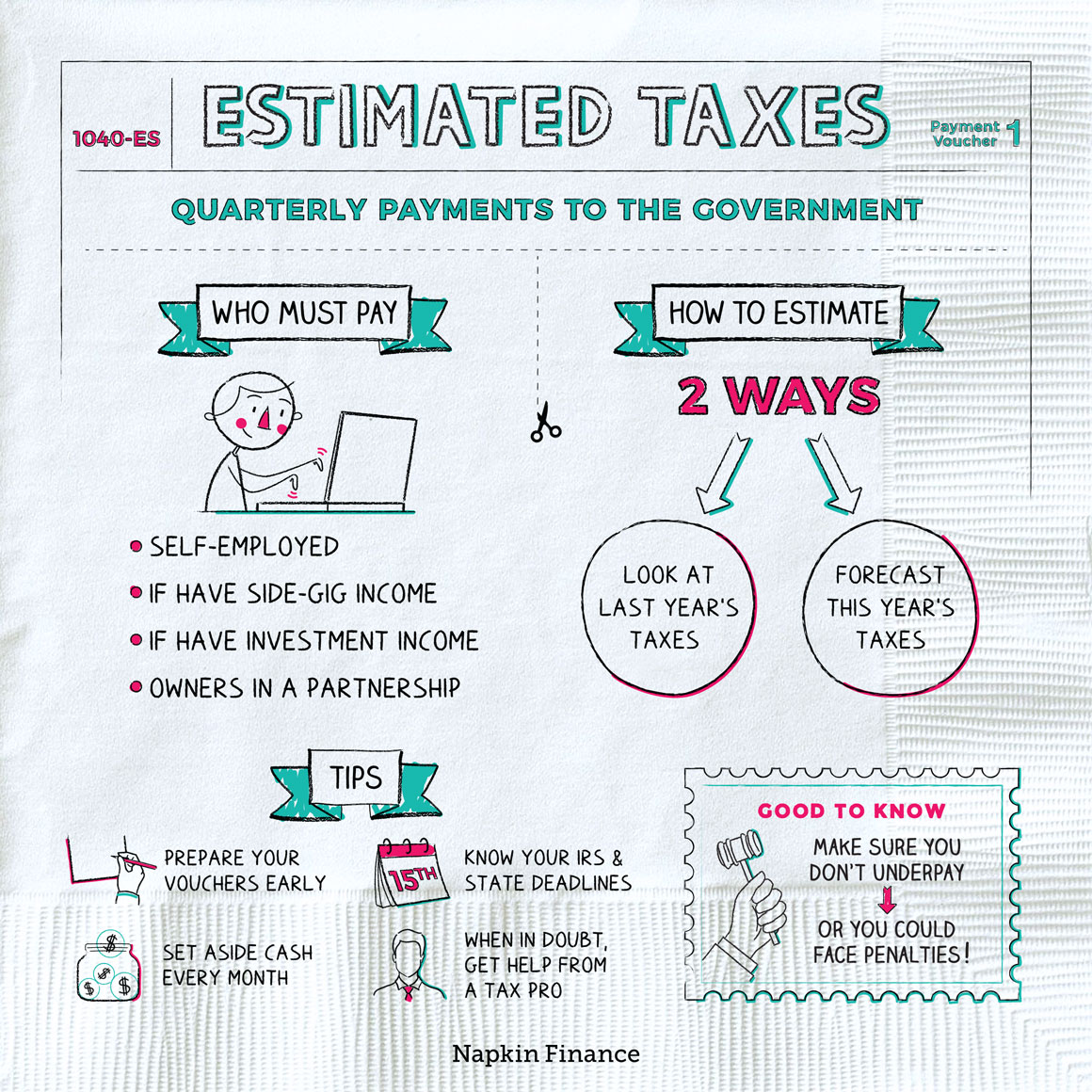

ESTIMATED TAXES Napkin Finance, Sign up now to obtain new tax calculator updates. Married medicare beneficiaries that file separately pay a steeper surcharge because.

When Are Estimated Taxes Due?

On june 26, 2024, i submitted to congress the national taxpayer advocate fiscal year 2025 objectives report to congress, which outlines the 2024 filing season.

You Pay Tax As A Percentage Of Your Income In Layers Called Tax Brackets.

For income earned in 2024, you’ll make three payments in.

Category: 2025